All about Eb5 Investment Immigration

Table of ContentsSee This Report about Eb5 Investment ImmigrationThe Buzz on Eb5 Investment ImmigrationFacts About Eb5 Investment Immigration UncoveredGetting My Eb5 Investment Immigration To WorkThe Of Eb5 Investment Immigration

While we strive to use accurate and updated content, it ought to not be considered legal suggestions. Migration legislations and regulations undergo alter, and specific circumstances can vary extensively. For individualized advice and legal suggestions concerning your certain migration situation, we strongly recommend talking to a certified migration lawyer that can supply you with tailored assistance and guarantee compliance with existing regulations and regulations.

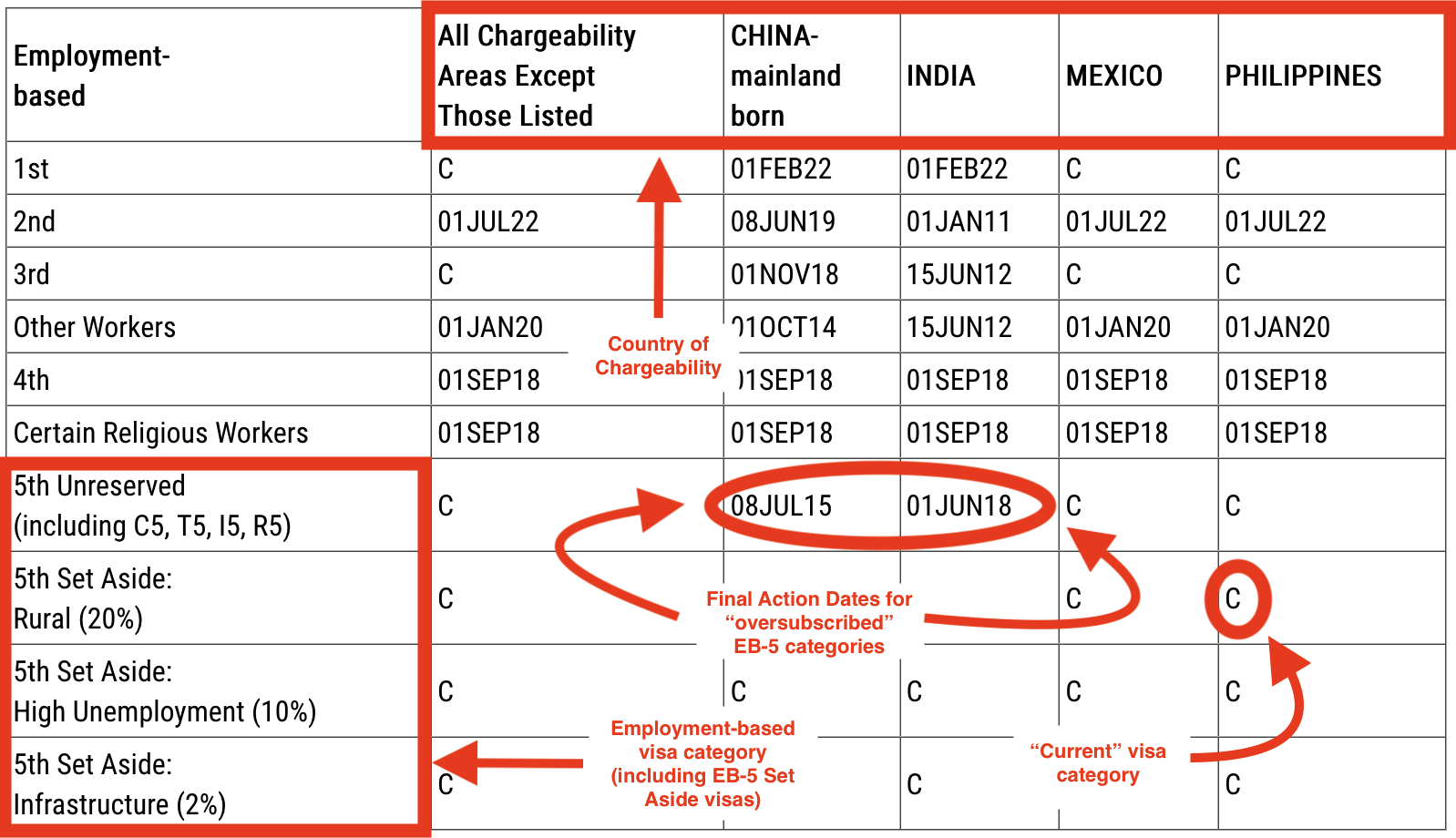

Citizenship, with investment. Presently, as of March 15, 2022, the quantity of financial investment is $800,000 (in Targeted Employment Areas and Backwoods) and $1,050,000 in other places (non-TEA zones). Congress has actually approved these amounts for the following five years beginning March 15, 2022.

To qualify for the EB-5 Visa, Capitalists need to create 10 full time united state work within two years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Demand guarantees that financial investments contribute straight to the U.S. task market. This uses whether the work are produced directly by the business enterprise or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

The Greatest Guide To Eb5 Investment Immigration

These tasks are figured out via designs that make use of inputs such as growth costs (e.g., building and devices costs) or annual earnings generated by ongoing operations. In contrast, under the standalone, or straight, EB-5 Program, only direct, full-time W-2 employee positions within the business may be counted. A key danger of counting entirely on direct employees is that staff decreases as a result of market problems might cause inadequate full-time positions, potentially leading to USCIS denial of the capitalist's application if the work development demand is not satisfied.

The economic design then forecasts the variety of direct tasks the new company is most likely to develop based upon its awaited profits. Indirect work computed via financial models refers to employment generated in markets that supply the goods or services to the organization straight associated with the task. These work are created as a result of the increased demand for products, materials, or services that sustain the organization's operations.

Examine This Report on Eb5 Investment Immigration

An employment-based fifth choice category (EB-5) financial investment visa supplies a technique of becoming a long-term united state local for foreign nationals wishing to spend funding in the United States. In order to get this permit, an international financier must spend $1.8 million (or $900,000 in a Regional Facility within a "Targeted Employment Location") and create or maintain a minimum of 10 full time work for United States workers (excluding the financier and their prompt family).

This measure has actually been a tremendous success. Today, 95% of all EB-5 funding is raised and invested by Regional Centers. Considering that the 2008 monetary dilemma, accessibility to capital has actually been restricted and municipal budget plans continue to encounter considerable shortages. In numerous areas, EB-5 investments have filled up the financing gap, offering a new, crucial resource of capital for regional economic advancement tasks that revitalize areas, produce and sustain work, infrastructure, and solutions.

Eb5 Investment Immigration Can Be Fun For Everyone

More than 25 countries, including Australia and the United Kingdom, usage comparable programs to attract international financial investments. The American program is extra rigid than numerous others, calling for substantial threat for financiers in terms of both their financial investment and migration standing.

Households and individuals that seek to transfer to the United States on a long-term basis can look for the EB-5 Immigrant Capitalist Program. The United States this post Citizenship and Migration Services (U.S.C.I.S.) established out different requirements to get long-term residency via the EB-5 visa program. The demands can be summed up as: The investor has to fulfill funding financial investment amount needs; it is typically called for to make either a $800,000 or $1,050,000 funding financial investment amount into an U.S.

Speak with a Boston immigration attorney regarding your demands. Right here are the basic actions to obtaining an EB-5 capitalist permit: The very first action is to find a certifying investment opportunity. This can be a brand-new company, a local facility job, or an existing organization that will be broadened or reorganized.

Once the opportunity has been determined, the capitalist has to make the financial investment and submit an I-526 request to the united state Citizenship and Migration Services (USCIS). This application has to consist of proof of the financial investment, such as financial institution declarations, acquisition agreements, and organization plans. The USCIS will evaluate the I-526 request and either accept it or request extra proof.

Eb5 Investment Immigration Fundamentals Explained

The financier should obtain conditional residency by submitting an I-485 application. This application has to be sent within six months of the I-526 approval and have to consist of proof that the financial investment was made and that it has actually produced a minimum of 10 full time tasks for U.S. workers. The USCIS will review the I-485 application and either authorize it or request additional evidence.